Real estate is one of the most popular—and time-tested—ways to build long-term wealth. But for beginners, diving into this market can feel overwhelming. From jargon and financing to location scouting and tenant management, the learning curve is real.

This beginner’s guide is designed to demystify real estate investing and help you get started with confidence.

🧭 Why Real Estate?

Real estate is a tangible asset that appreciates over time and generates passive income. Unlike stocks or crypto, it gives you more control and often less volatility. With the right approach, it can provide both monthly cash flow and long-term capital growth.

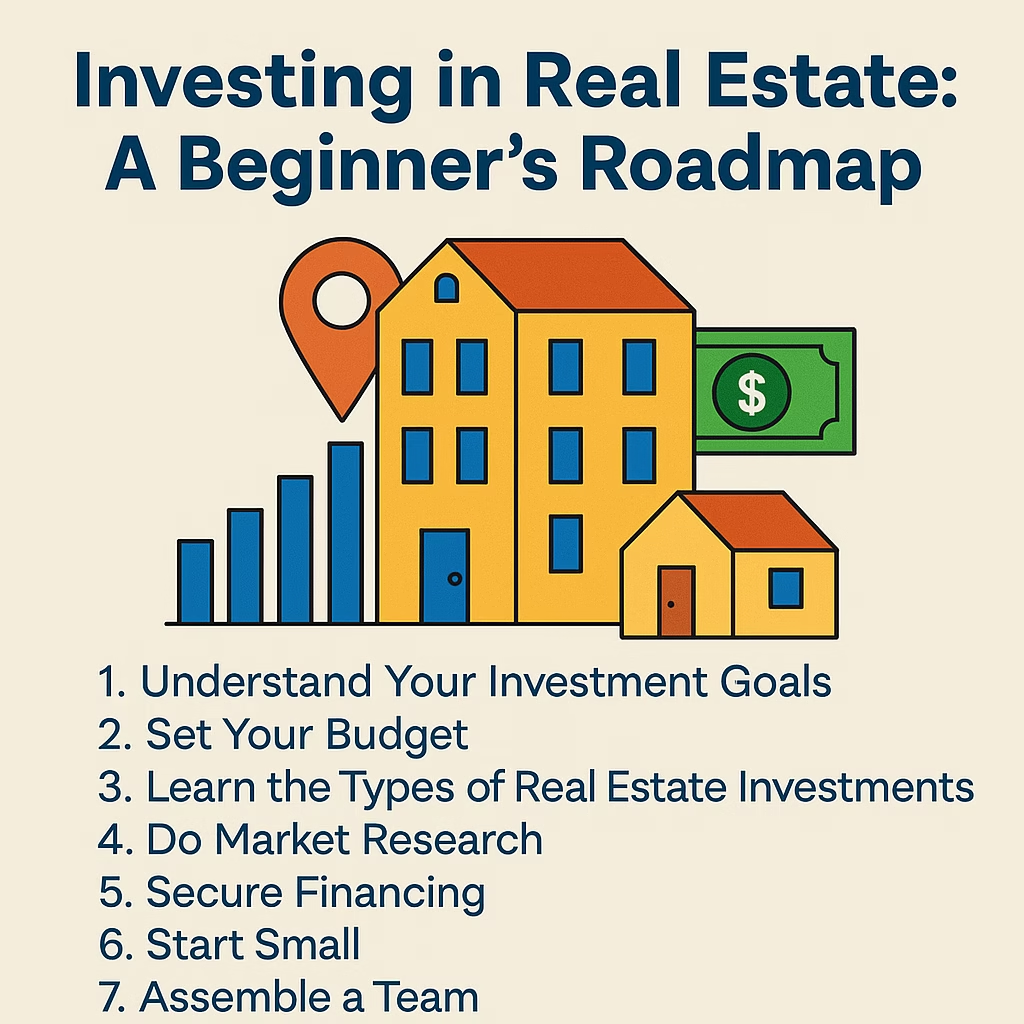

🪜 Step-by-Step: How to Start Investing

1. Understand Your Investment Goals

Are you looking for passive income, long-term appreciation, or a quick flip? Define your goals early to guide your strategy.

2. Set Your Budget

Start with what you can realistically afford. Consider:

- Down payment (typically 15–25%)

- Loan eligibility

- Emergency funds and repair reserves

3. Learn the Types of Real Estate Investments

- Residential Rentals: Single-family homes or apartments

- REITs (Real Estate Investment Trusts): Stock-like investments in property portfolios

- House Flipping: Buying low, renovating, and selling high

- Short-Term Rentals: Think Airbnb, great for high-tourism areas

4. Do Market Research

Look into cities and neighborhoods with:

- Population growth

- Job opportunities

- Low crime rates

- Affordable property taxes

5. Secure Financing

Explore mortgage options from banks, credit unions, or private lenders. A good credit score and low debt-to-income ratio are essential.

6. Start Small

Your first property doesn’t have to be huge. Many investors start with a single rental unit or duplex.

7. Assemble a Team

You may need:

- A real estate agent

- A mortgage broker

- An inspector

- A property manager (if you don’t want to self-manage)

📈 Pros of Real Estate Investing

- Predictable cash flow

- Leverage (borrowed capital to increase returns)

- Inflation hedge

- Tax benefits (deductions, depreciation, etc.)

⚠️ Common Beginner Mistakes to Avoid

- Overestimating rental income

- Underestimating maintenance costs

- Buying in a poor location

- Neglecting tenant screening

- Not doing proper due diligence

✅ Final Thoughts

Real estate investing isn’t just for millionaires or financial experts. With a bit of research, planning, and patience, anyone can begin building wealth through property.

Whether you’re buying your first rental or exploring REITs, the key is to start smart, think long-term, and stay informed.